The smart Trick of Simply Solar Illinois That Nobody is Talking About

Table of ContentsSee This Report about Simply Solar IllinoisThe smart Trick of Simply Solar Illinois That Nobody is DiscussingNot known Incorrect Statements About Simply Solar Illinois Things about Simply Solar IllinoisThe Best Strategy To Use For Simply Solar Illinois

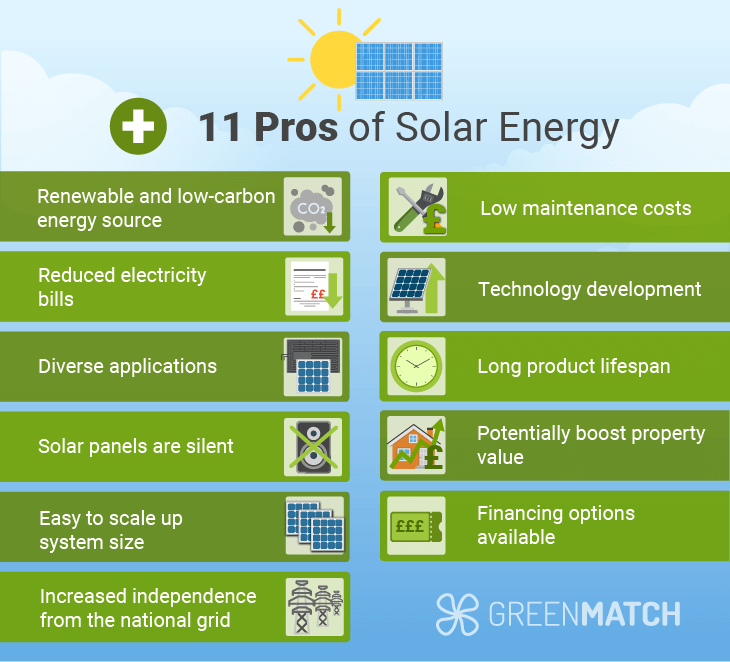

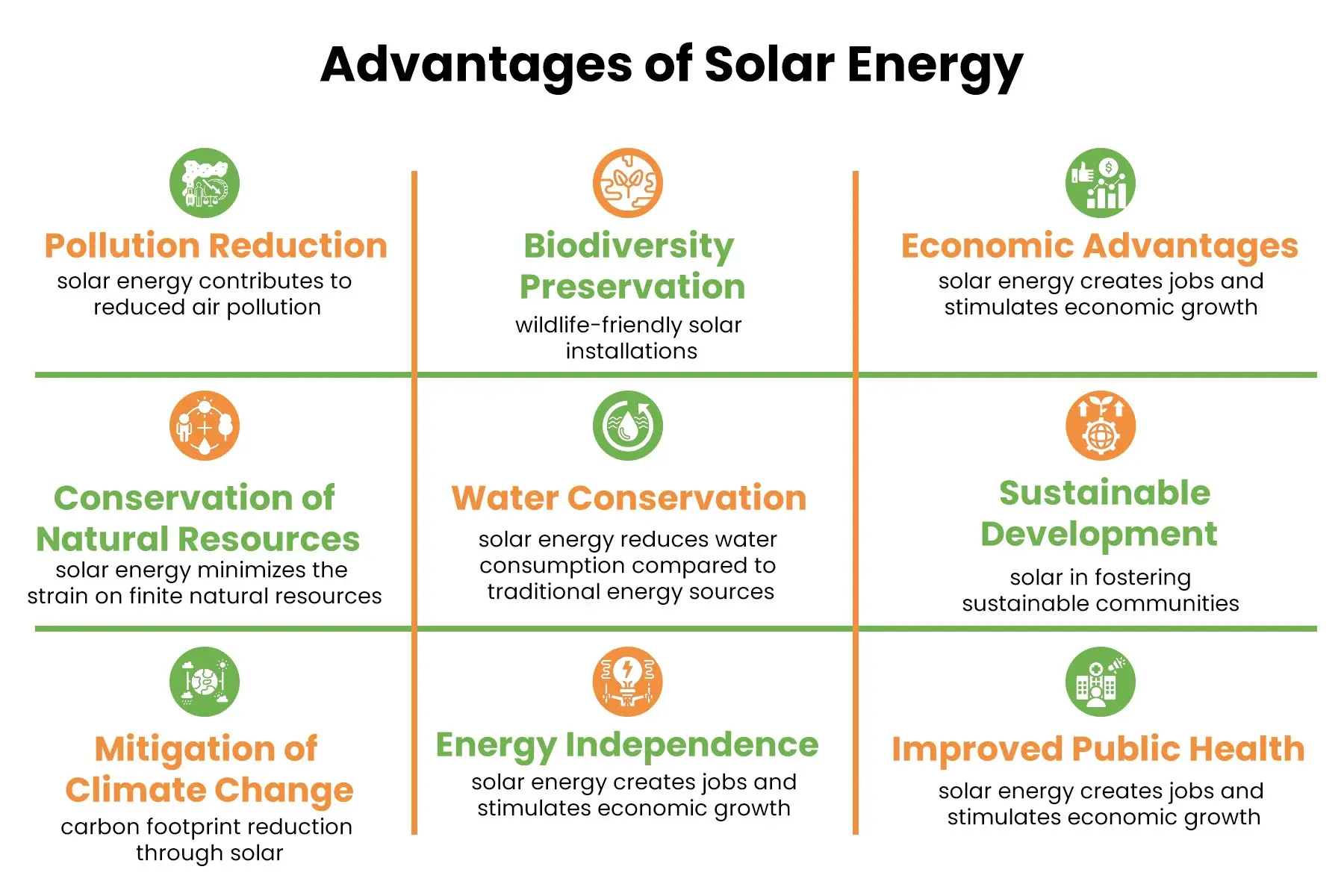

Our team partners with neighborhood areas throughout the Northeast and beyond to supply tidy, budget-friendly and reputable power to promote healthy areas and keep the lights on. A solar or storage space task provides a number of advantages to the neighborhood it serves. As modern technology advancements and the expense of solar and storage decrease, the economic advantages of going solar remain to climb.Assistance for pollinator-friendly habitat Environment remediation on infected sites like brownfields and land fills Much needed color for livestock like lamb and chicken "Land financial" for future agricultural usage and soil top quality enhancements Due to climate change, extreme climate is ending up being extra regular and turbulent. As a result, homeowners, organizations, neighborhoods, and energies are all becoming an increasing number of thinking about safeguarding energy supply options that offer resiliency and power security.

Environmental sustainability is an additional crucial driver for companies purchasing solar power. Numerous companies have robust sustainability goals that include decreasing greenhouse gas discharges and utilizing less sources to assist decrease their influence on the native environment. There is an expanding seriousness to resolve climate modification and the pressure from customers, is getting to the leading degrees of organizations.

Not known Facts About Simply Solar Illinois

As we approach 2025, the assimilation of solar panels in business tasks is no more simply an alternative however a strategic need. This blogpost digs right into just how solar power works and the multifaceted benefits it gives business structures. Photovoltaic panel have actually been made use of on domestic structures for several years, yet it's just just recently that they're becoming a lot more usual in industrial building and construction.

In this post we review just how solar panels job and the advantages of utilizing solar energy in commercial structures. Power prices in the U.S. are enhancing, making it extra expensive for businesses to run and more difficult to intend ahead.

The United State Energy Details Management anticipates electric generation from solar to be the leading resource of development in the U.S. power field with completion of 2025, with 79 GW of new solar ability forecasted ahead online over the following two years. In the EIA's Short-Term Power Overview, the agency stated it expects renewable power's overall share of electrical energy generation to climb to 26% by the end of 2025

The 2-Minute Rule for Simply Solar Illinois

The sunlight causes the silicon cell electrons to propel, producing an electrical current. The photovoltaic solar battery absorbs solar radiation. When the silicon connects with the sunlight rays, the electrons start to relocate and create a circulation of direct electric existing (DC). The wires feed this DC electrical power right into the solar inverter and convert it to rotating power (AIR CONDITIONER).

There are numerous means to save solar power: When solar energy is fed into an electrochemical battery, the chain reaction on the battery components keeps the solar energy. In a reverse reaction, the current exits Continue from the battery storage space for intake. Thermal storage space makes use of tools such as liquified salt or water to maintain and take in the warm from the sun.

Solar panels significantly decrease power costs. While the preliminary investment can be high, overtime the cost of setting up solar panels is recovered by the money saved on power costs.

Fascination About Simply Solar Illinois

By installing solar panels, a brand reveals that it appreciates the atmosphere and is making an effort to minimize its carbon footprint. Buildings that depend entirely on electric grids are prone to power failures that happen throughout poor weather condition or electrical system breakdowns. Solar panels mounted with battery systems permit industrial buildings to remain to function throughout power outages.

An Unbiased View of Simply Solar Illinois

Solar power is among the cleanest kinds of power. With resilient guarantees and a manufacturing life of approximately 40-50 years, solar financial investments add significantly to ecological sustainability. This shift towards cleaner energy resources can result in more comprehensive economic benefits, including minimized environment adjustment and ecological degradation expenses. In 2024, property owners can profit from government solar tax motivations, enabling them to counter virtually one-third of the purchase price of a planetary system with a 30% tax credit scores.